Peak Wealth Architects

As business owners, we at Peak Wealth Architects know firsthand that outside of payroll, one of the biggest expenses is taxes. While we believe we should all pay our fair share, we also believe there is no need to overpay. Like many, we mistakenly thought the solution to the tax burden was to hire a bookkeeper or CPA to tell us how much is owed, to send a check, and be done with it. After years of operating under this false assumption, we realized that uber high net-worth individuals – the hundred-millionaires and billionaires of the world – were making money in many different businesses and, in many cases, paying little to no taxes.

How is this possible? We wanted to learn how we could be doing what they were doing, because the law is the same for everybody. After talking to experts that handle financial planning and tax strategies for these high net worth individuals, we realized most do not use the typical CPA or resources we have available as smaller business owners. Rather, they have entire offices that handle everything in relation to their net worth, investments, wealth protection, and taxation. Within that environment, the level of specialization is such that these experts know all the regulations to optimize the structuring of these clients’ taxes. We thought to ourselves, “why doesn’t everyone do that?”

Peak Wealth Architects In Numbers

We’re a team of business professionals that combined offer the following:

Clients

Licensed in States

Success Ratio

Yearly Taxes Recaptured Per Client

No Cure No Pay Guarantee

Meet the Team

Introducing the creative and committed team members who make our success possible every day.

Katie H.

Headhunter

Before Peak Wealth Architects, I did everything myself; all of my bookkeeping, all of my tax filing. I met them pretty soon after I started my business. That was just a little bit of good luck on my part, or on the universe’s part, but I’m lucky because they were able to come in at a pretty early stage of my business growth and really lay the groundwork and put some structure in place where I probably wouldn’t have even know that I needed it. It really, really took a load off of my shoulders emotionally as well; I wasn’t sitting up at night worrying about how I was going to file the taxes for my business.

Praveen K.

Tech Industry Veteran

Before, it was end-of-the-year taxes and just going through the motions. What Peak Wealth Architects brings to the table is having an end to end perspective in terms of breaking it down, peeling off the layers. I would strongly recommend them. It’s about knowing how best to run your business from a tax perspective. And instead of completely relying on someone else, the approach here is that they bring you up to speed in terms of knowledge that you need to make the right decision. So you’re not outsourcing your decision, you’re making it yourself.

Dan M.

Consultant and Real Estate Investor

I was thinking, there’s got to be someone out there that really understands the inner workings of the tax code and how to optimize taxes, how to structure things such that you can kind of get the best deductions. Peak Wealth Architects fit the bill. Ultimately, with the money Peak Wealth Architects saved me, I was able to grow my investment portfolio quite a bit – and now I’m looking at other new investment opportunities. I like Cryptocurrency; I like real estate. So now, I’m able to spread out my assets and investment portfolio with all the money I saved.

Here, we let the numbers speak for us.

We’re a team of business professionals that combined offer the following:

| 32,000+ Clients | Thousands of Tax Returns Filed Per Year | Hundreds of Millions Of Tax Recaptured Each Season |

| Billions of Assets Protected | Licensed in 50 states | $40,000 Avg Yearly Taxes Recaptured Per Client |

| 40+ CPA’s, EA’s, business and tax lawyers | 100% Done-For-You | 50+ Years of Experience |

| 100% Success Ratio | 100% No-Cure-No-Pay Guarantee |

32,000+ clients | Thousands of Tax Returns Filed Per Year | Hundreds of Millions Of Tax Recaptured Each Season |

Billions of Assets Protected | Licensed in 50 states | $40,000 Avg Yearly Taxes Recaptured Per Client |

40+ CPA’s, EA’s, business and tax lawyers | 100% Done-For-You | 50+ Years of Experience |

100% Success Ratio | 100% No-Cure-No-Pay Guarantee |

Don’t just take our word for it - see what some of our clients have to say!

Katie Hajec

CEO of K-Team

Before Peak Wealth Architects, I did everything myself; all of my bookkeeping, all of my tax filing. I met them pretty soon after I started my business. That was just a little bit of good luck on my part, or on the universe’s part, but I’m lucky because they were able to come in at a pretty early stage of my business growth and really lay the groundwork and put some structure in place where I probably wouldn’t have even know that I needed it. It really, really took a load off of my shoulders emotionally as well; I wasn’t sitting up at night worrying about how I was going to file the taxes for my business.

The savings were substantial, and by substantial, we’re talking in the thousands. Which as a small business owner and new business owner, every penny counts. So, I was able to really see clearly where I was going to be saving in working with Peak Wealth Architects versus if I were to file myself or potentially use another company. So it was exciting to see that and now looking back several years later, see that what they promised me was followed through on.

I have saved everything and now am able to plan for other investments and keep it in my business. Keeping as much capital as possible in the business is really important, especially during these crazy financial times where the market is changing very rapidly, especially in many areas of business so having the psychological security to know where my money is has been very nice for me, and also empowering to know that I’m going to be able to invest those funds, not only for the future of my business, but also for my own future success personally.

————-

They were great in being patient and letting me ask a million questions, which I have continued to do to this day! I think for me, that was really helpful because as someone who for clearly this is not my area of expertise, being able to ask them all of these questions, they were patient, they walked me through so many things. They never made me feel silly, they never made me feel stupid about anything I was asking. As a business professional, I think that psychological security and knowing whatever I needed from them, whether I understood it immediately or not, they would help me understand it pretty soon after, that was really really powerful.

Don’t be afraid to ask any questions! They are an open book and extremely knowledgeable across the board. Comprehensively, they take care of your business from a financial perspective. Oftentimes, as I was asking questions about one area of my business, I would discover that there were other areas that they could benefit me that maybe I didn’t even know. I would really encourage people to go in with an open mind, not feel silly about not being the subject matter expert in their field, and really be able to ask them those questions.

The process was relatively easy! They set me up with what to expect, a list of items I would need to prepare for them, which were relatively simple, just some statements I could easily print from my bank, for my respective accounts, and various other items; so I knew going into it what they would need from me.

I never felt pestered; everything was pretty simple for me to navigate as someone who was letting them do their thing. They would let me know what they needed from me and I would provide them access to all of that stuff, they would then do their thing if they needed anything else, they would reach out via email and ask any questions they might have and then from there it was okay “here’s what we’re going to file,” “does this look okay,” “do you have any questions about this?” and then once it all made sense to me, we would do the sign-off and they would handle it on their end and actually do the filing.

Don’t be afraid to entrust in someone else – money and finances can be very scary and especially when it comes to a new venture or business, let alone your personal finances. Don’t be afraid to take a chance, speak to whomever you need to speak to, ask a million questions if it’s helpful to you, and again don’t be afraid to hand over the keys to the kingdom to your finances in a trusted professional who has far more knowledge than you could ever hope to have in a relatively short amount of time and let them do their job and save you money and be a part of your business journey and business success. It really does take a village and you’re stronger together than you are alone.

Praveen Kanyadi

Tech Industry Entrepreneur

My start-up, which I co-founded, got acquired by UKG, one of the leading software companies for workforce management. After the acquisition, when I started making some money, I was looking for financial advice and that’s when I got in touch with Peak Wealth Architects. It’s a whole different view they offered. I wasn’t even aware of all the solutions that they presented. It’s been a massive learning experience for me; I’m glad I got the chance to work with them because it’s opened up several avenues for me. I wish I had worked with them prior to the acquisition.

I discovered tax savings opportunities I wasn’t even aware of. It’s not just about saving taxes, it’s also about how you structure your business, how you structure and protect your assets.

I think the most important part for me was not just the tax piece, but the financial advice. It’s a more holistic way of looking at things than just saving taxes.

Before, it was end-of-the-year taxes and just going through the motions. What Peak Wealth Architects brings to the table is having an end to end perspective in terms of breaking it down, peeling off the layers. I would strongly recommend them.

It’s about knowing how best to run your business from a tax perspective. And instead of completely relying on someone else, the approach here is that they bring you up to speed in terms of knowledge that you need to make the right decision. So you’re not outsourcing your decision, you’re making it yourself.

In general, I feel I’m in a significantly better place than I was prior to meeting Peak Wealth Architects.

Dan Manheim

CEO of Manheim Consulting

Taxes are pretty painful and costly. I had a number of CPAs and they were all basically glorified form fillers. I was looking for someone who could do more on the tax front other than effectively be kind of a fancy TurboTax.

I was thinking, there’s got to be someone out there that really understands the inner workings of the tax code and how to optimize taxes, how to structure things such that you can kind of get the best deductions. Peak Wealth Architects fit the bill.

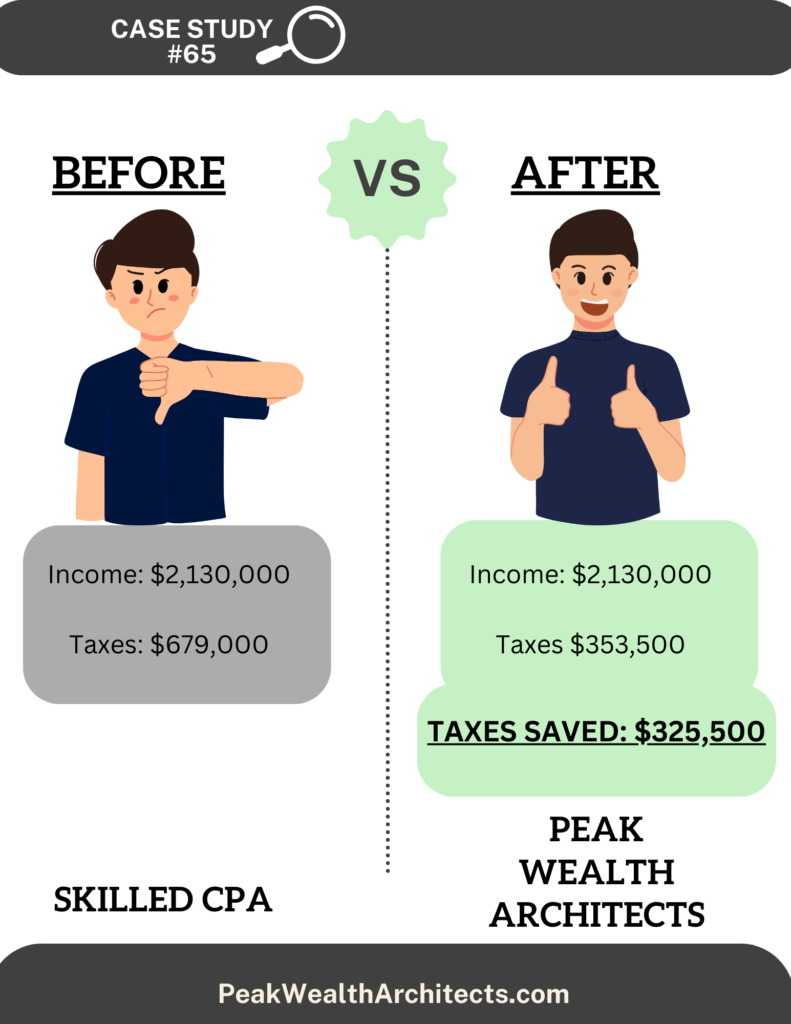

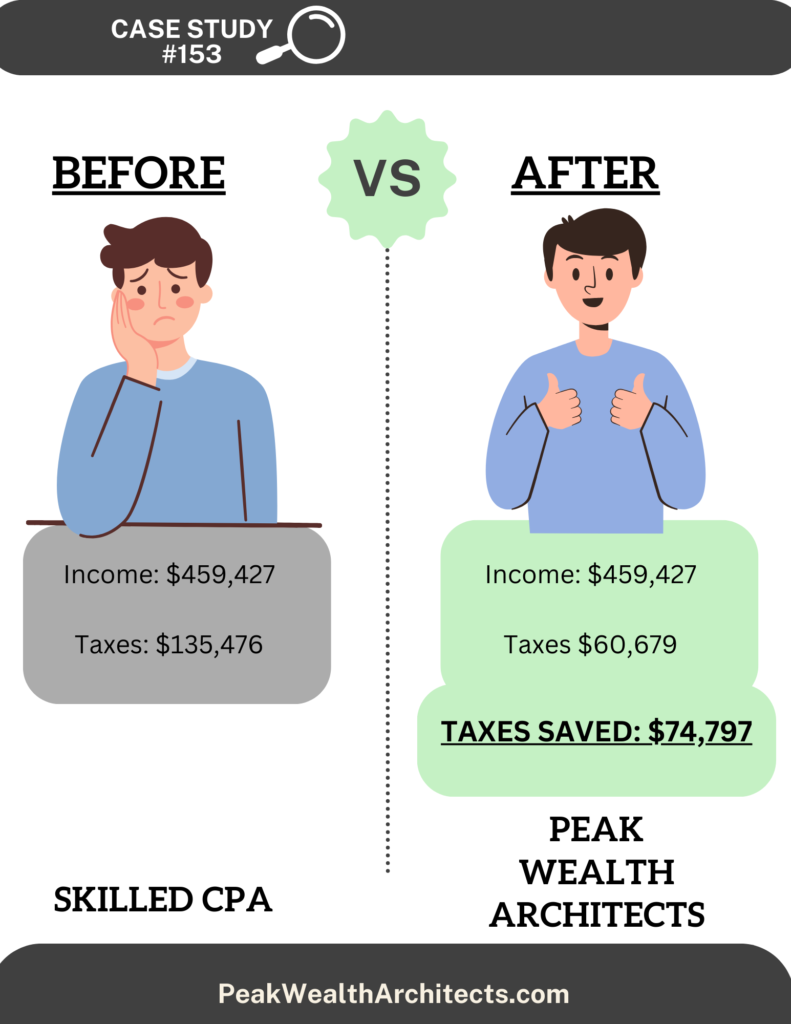

They got more involved in understanding my business and what I could do to optimize the business in terms of taxes. The biggest thing is that they set me up with a new tax structure that really helped me leverage more of the deductions that are involved in the tax code which ultimately drastically lowered my tax liabilities per year, at least 50% which is actually pretty surprising. When I first spoke to Peak Wealth Architects,I was kind of skeptical, thinking if it’s too good to be true, it probably is. But, in this case, it’s not – and I’m really happy with it. I asked all the questions that I could think of. I couldn’t find any loopholes or gaps that seemed reasonable.

Ultimately, with the money Peak Wealth Architects saved me, I was able to grow my investment portfolio quite a bit – and now I’m looking at other new investment opportunities. I like Cryptocurrency; I like real estate. So now, I’m able to spread out my assets and investment portfolio with all the money I saved.

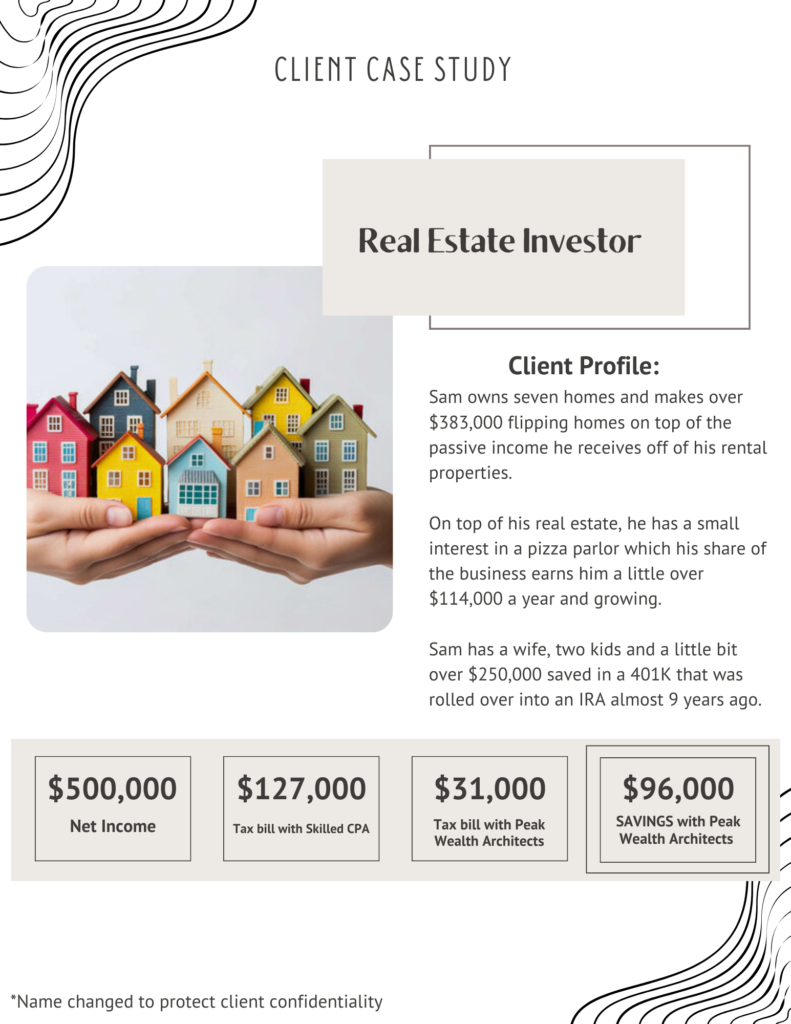

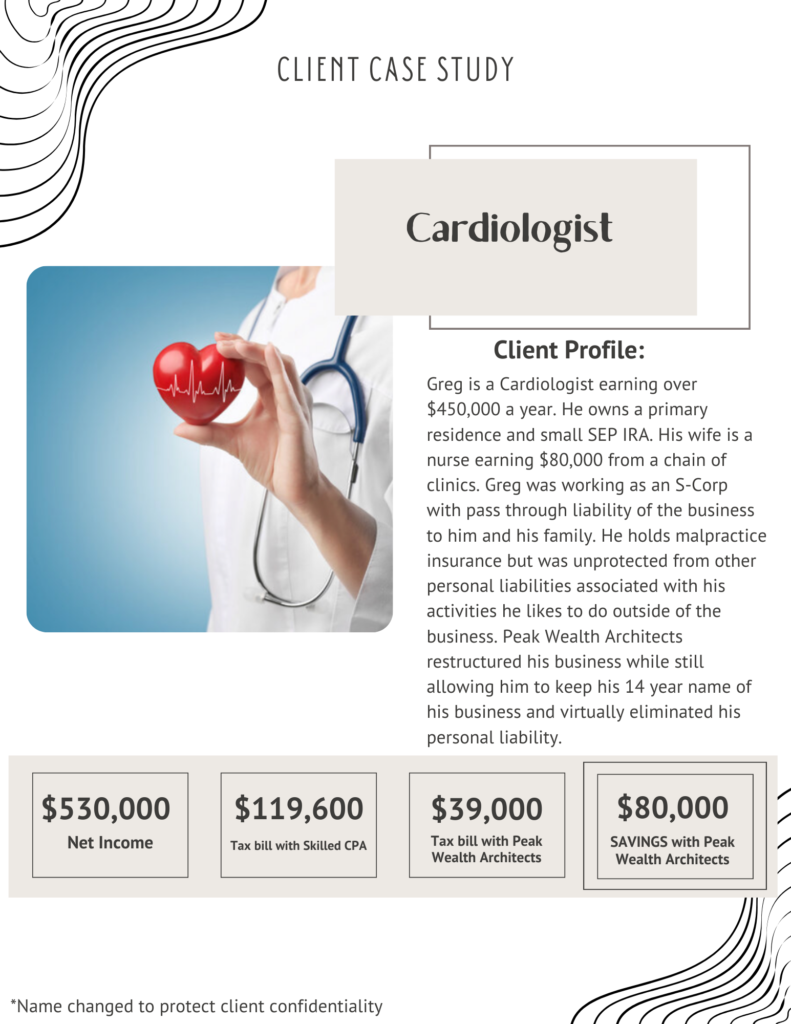

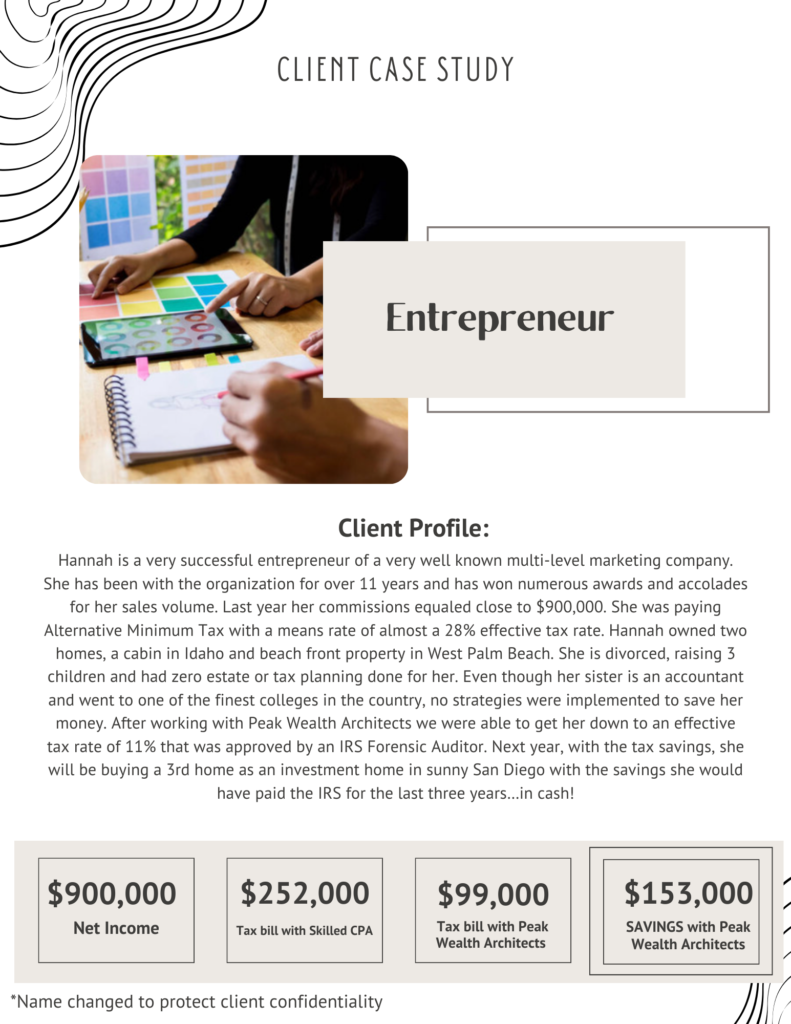

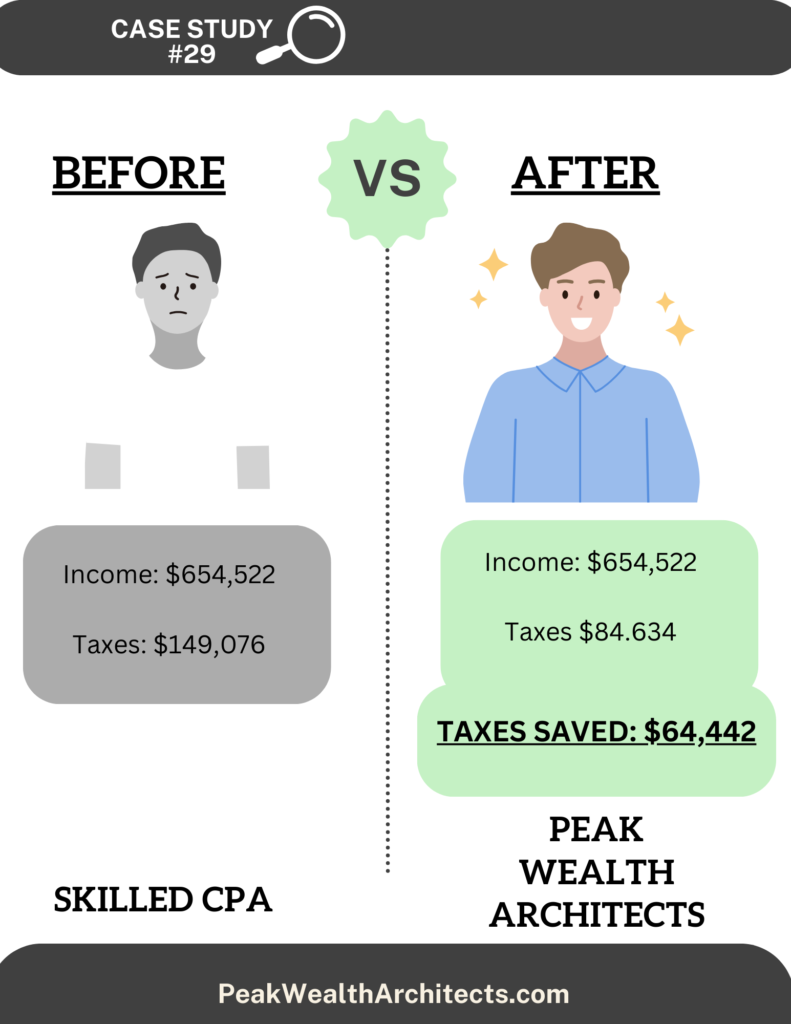

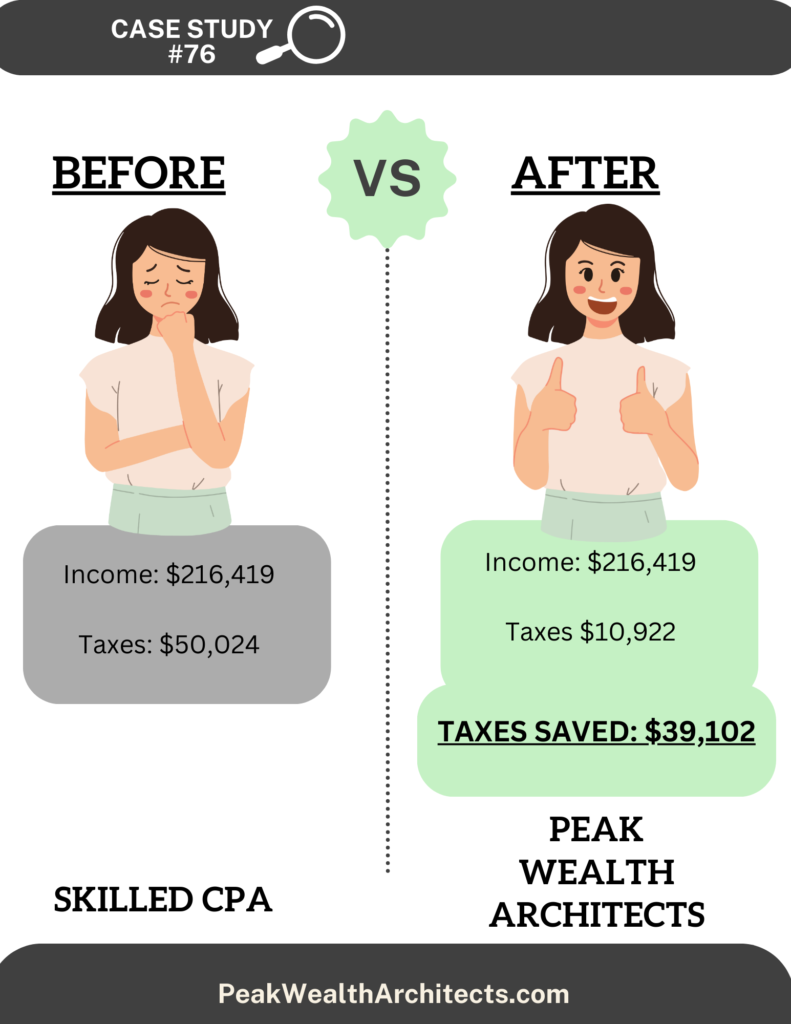

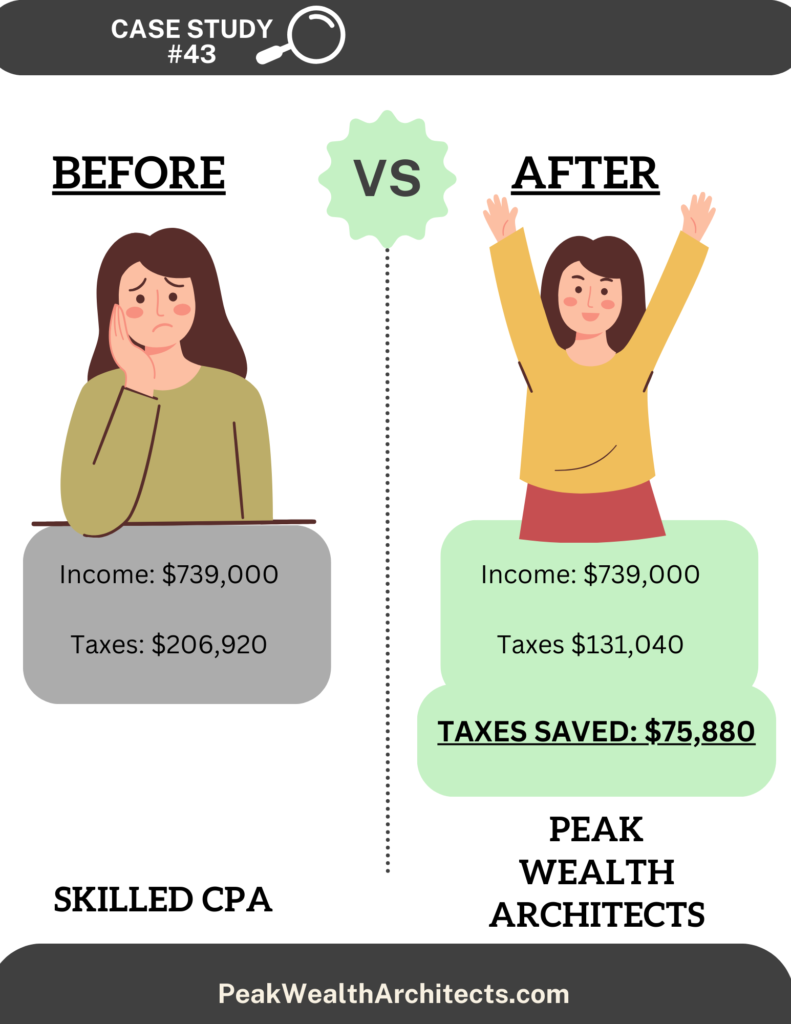

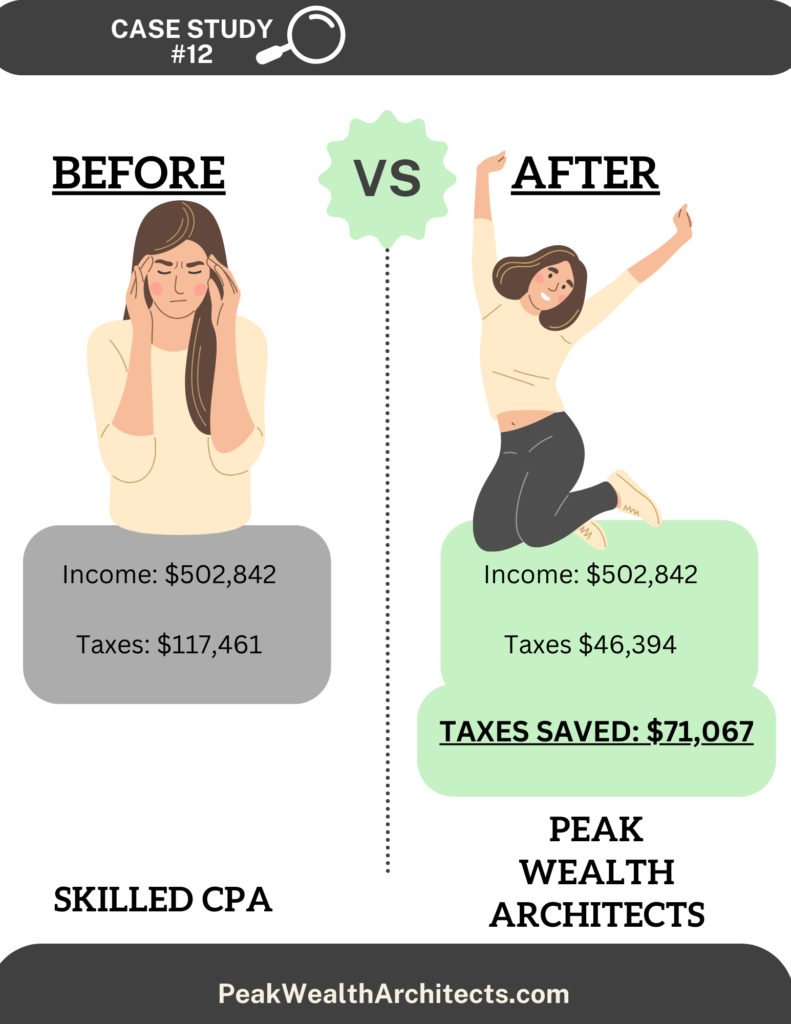

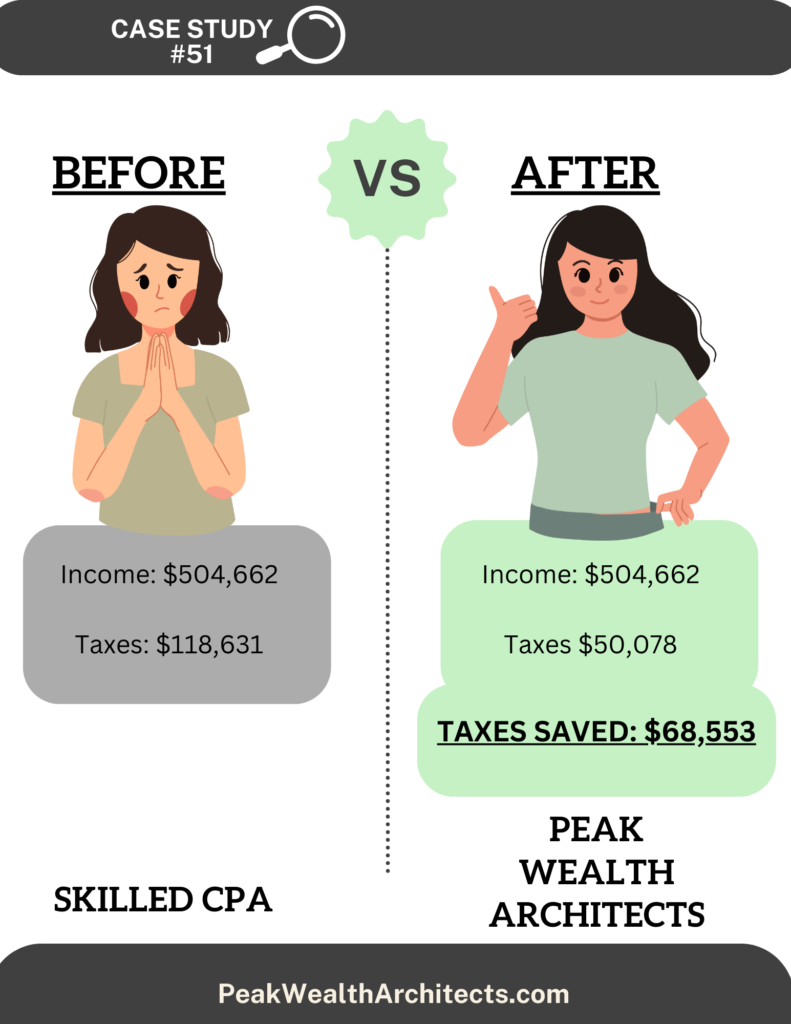

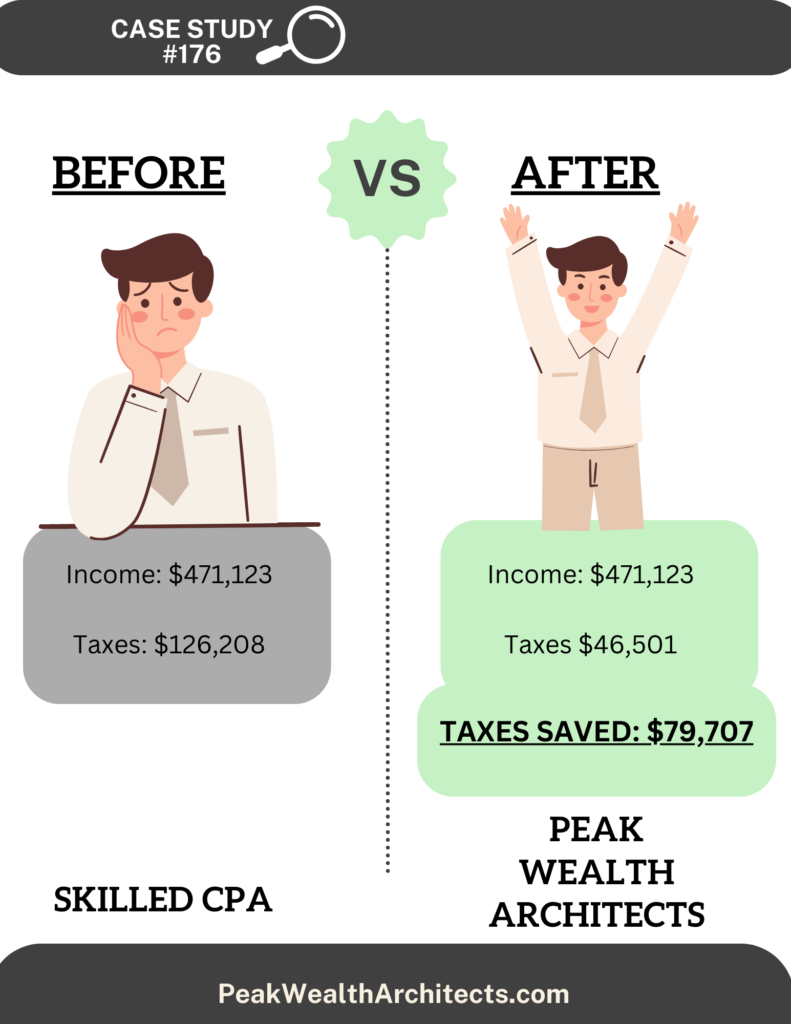

Case Studies

Our History

We learned that for many of these teams, a client must have a net worth of $100 million+ to even get an invitation to talk to them. While a lot of small business owners are successful and may have a seven or eight figure business, not as many make hundreds of millions worth of profit. We asked ourselves how we can take the value that these specialists provide and organize that for smaller businesses and offer it for a fraction of the price – and that’s what we specialize in at Peak Wealth Architects.

Our specialists evaluate your personal situation, your business situation, cash flow, and even the current work of your CPA and make recommendations on how you can further improve your situation while remaining compliant with all federal rules and regulations.

All of our clients have a drastically reduced tax bill. In fact, it’s not uncommon for Peak Wealth Architects clients to have a tax bill between 0-10% while their colleagues have a tax bill between 25-50%. Ask yourself why you’re paying the IRS your hard-earned money that Peak Wealth Architects could be saving you and request a strategy consultation with our experts.